What type of taxes are charged on local sales in Canada?

There are two types of taxes in Canada. One is levied by the provinces, and the other is charged by the federal government.

These can be broken down into 4 separate taxes, and that’s how they will appear in your invoices:

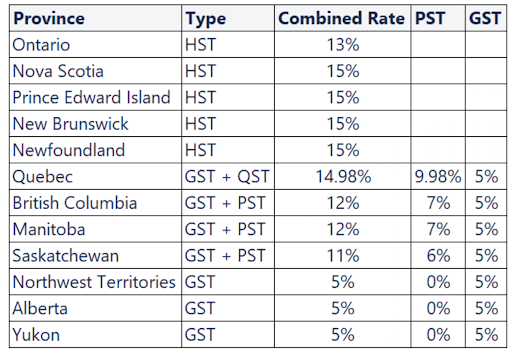

- Goods and Services Tax (GST) is a federal tax that applies to all sales in all provinces of Canada.

- Harmonized Sales Tax (HST) is a combination of the Goods and Services Tax and the provincial portion of the sales tax and applies to all sales into Ontario, Nova Scotia, Prince Edward Island, New Brunswick, and Newfoundland.

- Provincial Sales Tax (PST) is levied by the provinces on orders shipped to Manitoba, Saskatchewan and British Columbia.

- Quebec Sales Tax (QST) is a provincial tax levied on shipments to Quebec.

Canadian provinces charge either only the GST or the GST combined with a Provincial Sales Tax (PST). In provinces with the Harmonized Sales Tax (HST), the provincial portion of the tax has already been added to the combined rate.

Learn more about Canadian tax exemption here.

We strongly recommend that you consult a tax specialist or CPA for professional advice on taxes and your potential obligations.